Trust Account Audit

Introduction Indian Trusts Act, 1882 – For private/public trusts. Income Tax Act, 1961 – Sections like 12A & 12AB require registered charitable trusts to get their accounts audited if income exceeds the […]

Introduction Indian Trusts Act, 1882 – For private/public trusts. Income Tax Act, 1961 – Sections like 12A & 12AB require registered charitable trusts to get their accounts audited if income exceeds the […]

The Central Board of Indirect Taxes & Customs (CBIC) on its Twitter handle has clarified that the GSTN system only validates the mandatory B2B section in GSTR-1 Return. CBIC wrote […]

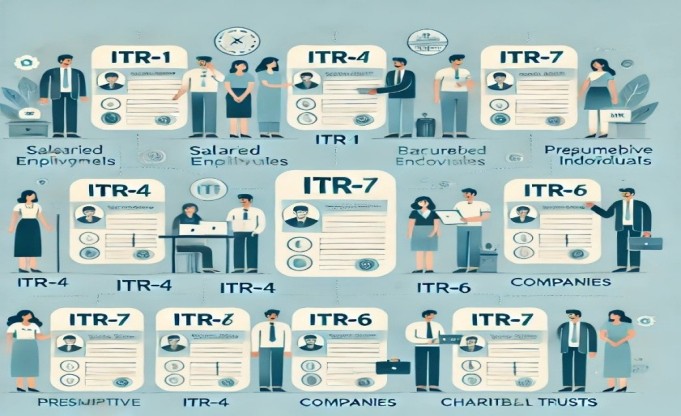

A simplified guide to help you choose the right Income Tax Return (ITR) form. ITR-1 (SAHAJ) – For Salaried Individuals Applicable to: Resident individuals (not Ordinarily Resident) with total income up […]